- MainSpring ETFs

- Posts

- 📈 MainSpring ETFs- Nothing Stops This Train

📈 MainSpring ETFs- Nothing Stops This Train

9.18.2024 | Daily ETF Market Morning Spring

Wednesday, September 18th, 2024

Good morning investors,

If you enjoy reading MainSpring, please, share the love. As always, please send us feedback at [email protected]

Data reflects end-of-day ETF market data for Tuesday, September 17th, 2024

💥 Use AI to 10X your productivity & efficiency at work (free bonus) 🤯

Still struggling to achieve work-life balance and manage your time efficiently?

Join this 3 hour Intensive Workshop on AI & ChatGPT tools (usually $399) but FREE for first 100 readers.

Save your free spot here (seats are filling fast!) ⏰

An AI-powered professional will earn 10x more. 💰 An AI-powered founder will build & scale his company 10x faster 🚀 An AI-first company will grow 50x more! 📊 |

Want to be one of these people & be a smart worker?

Free up 3 hours of your time to learn AI strategies & hacks that less than 1% people know!

🗓️ Tomorrow | ⏱️ 10 AM EST

In this workshop, you will learn how to:

✅ Make smarter decisions based on data in seconds using AI

✅ Automate daily tasks and increase productivity & creativity

✅ Skyrocket your business growth by leveraging the power of AI

✅ Save 1000s of dollars by using ChatGPT to simplify complex problems

Fed day is here, and for the first time in over a year we have a live meeting, and for the first time in about a year and a half, we have uncertainty about the magnitude too. 25 is a done deal, and the bond market thinks 50 is more likely. Whether the Fed goes 25 or 50, this will be the first time since the mid-90s that a Fed cut happened outside of a recession or a financial panic.

The market is pricing a 66% of a 50 basis point cut. But the overwhelming majority of economists expect 25. This is an unprecedented divergence. Typically, the day before the meeting, these odds are either 95%-100% or 0%-5%. So, this level of uncertainty alone is unusual.

Nobody will remember:

-Your salary

-How "busy" you were

-How many hours you workedPeople will remember:

-Whether you were calling for a 25bps or 50bps cut— Kevin Gordon (@KevRGordon)

7:55 PM • Sep 17, 2024

What’s going on in the pond?

Nothing stops this train:

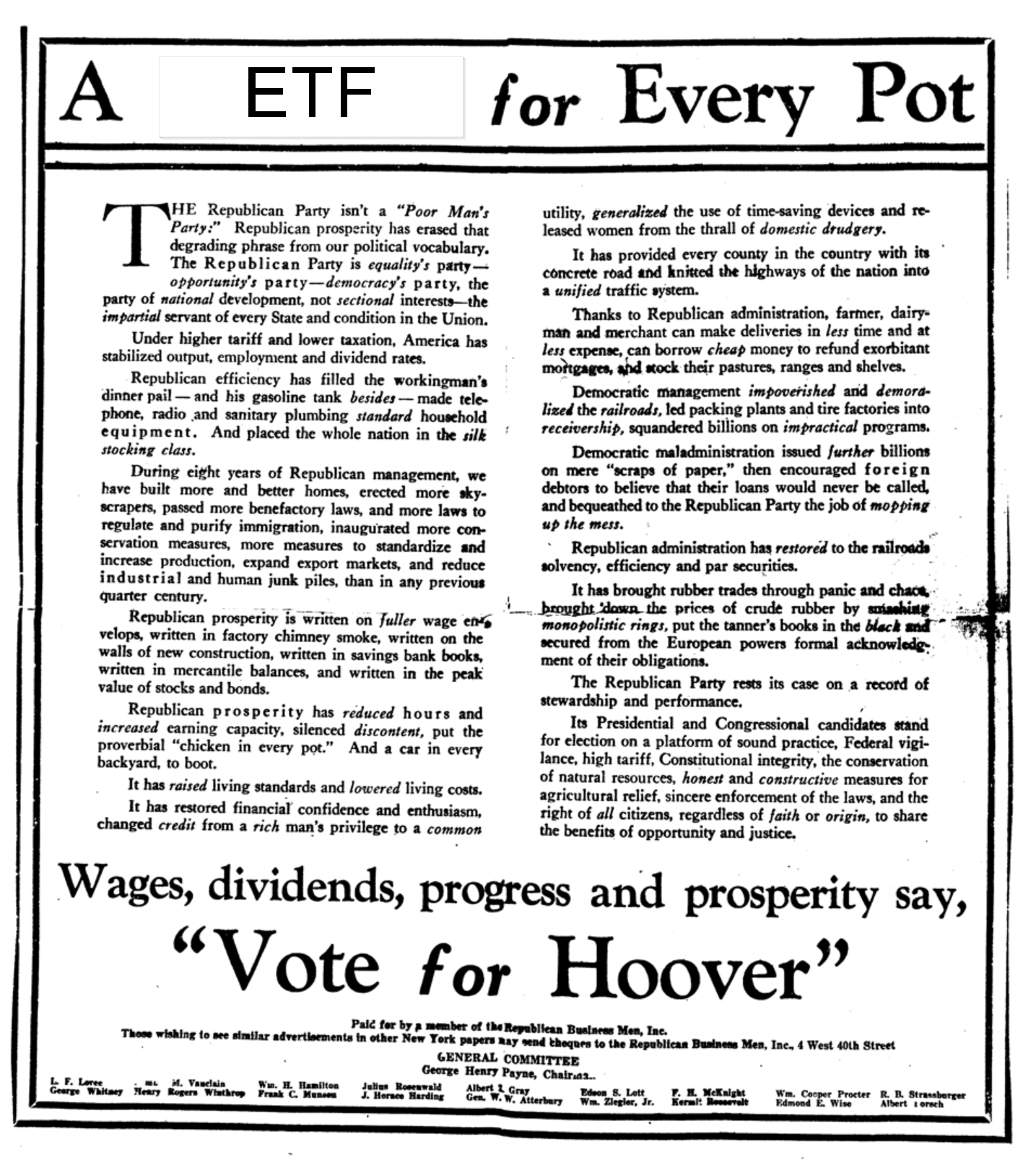

This is not the platform for a small duck to perch on his high branch and lecture our readers about the issues around the government’s debt burden. But, as the Fed is about to cut with the market at all-time highs, unemployment sitting at 4.2 percent, and nearly 40% of all Americans now own their homes mortgage-free. Why is one 25bp cut considered too small, and 50 more justified? If I had to guess, it would be the problems surrounding our country’s ability to service its growing debt burden. Amongst other things.

At one point, it made, some crumb of sense. As the Government ramped up spending in the wake of the GFC 08’ and the many wars we fostered, the interest rate was falling to zero, thus the payments were nothing. Which is great until it’s not….

I bring this up on Fed Day not to lecture but to simplify a theme I see brewing in the future. The current situation in which our country is in, is where debt is the only thing that matters, and to keep the game going there needs to be a few ingredients. One is growth at all costs, no matter how it happens, even if it costs the government a lot of money today this country needs growth, and we are getting it!

Atlanta Fed's GDPNow forecast is now nearly 3%, which is higher than where it was before the last Fed meeting at the end of July (see red arrow below.)

The second ingredient is a neutral level of interest rates, a rate where we can still grow as a country, employment remains healthy, the consumers remain healthy, the debt can be serviced comfortably at this rate. Nobody knows this rate, not even the FED. What we do know is that it isn’t 5.5%, and it isn’t Zero! So, why is today so important? Today the Fed embarks on a journey to find a rate at which this country can sustainably fuel growth, without inflation eroding our savings but where there is enough inflation to slowly burn the debt away. We also need to be able to pay for the constant escapades in foreign nations, plus whatever the campaign trails promise. All this is to say our country is in a form of fiscal dominance, one where the government spending is holding many aspects of our economy together, this isn’t a bad thing as long as you know the importance of being invested in the market, whether it is in equities, commodities, real estate, gold, bitcoin (I heard ETFs do a great job of offering diversification) or, preferably, some combination.

In summary… Nothing Stops This Tain!

The funny thing about the “nothing stops this train” meme is how long it goes, for everyone.

The deficits will be big, the consequences will be profound, and yet little will change this decade except around the margins.

Strap in.

— Lyn Alden (@LynAldenContact)

11:41 PM • Sep 17, 2024

What I am reading today:

These are things I have found interesting, novel, or educational. Popular sites include TrackInsight, ETF.com, Bloomberg & ETF Trends

Check out the ETF Tools Page

Check out the 100 Latest ETFs issued.

Check out quantitative leveraged ETF trading at alphaAI

Check out this Earings tracker Calendar. Find out who is reporting, and when… All in one place.

Deeper insight into this week’s earnings, here.

Follow the MainSpring Twitter/X page! Let me know how I can make this the most valuable newsletter you read today!

Are you liking this Newsletter, honestly?Please let me know how you feel about this newsletter, it is getting better each day, but I need some feedback! |

Please reply and let me know what you’d like to see, anything you think would be useful, or insightful.

Life is rich,

- Addison

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.

Reply